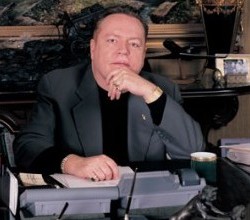

From Richard Heinberg

Salvaging the American Dream

A FRONTLINE ACTIVIST AND AUTHOR EXPLAINS WHY WE’RE NOW PAYING THE PRICE FOR AN OVERRELIANCE ON FOSSIL FUELS AND EASILY OBTAINABLE CREDIT—BUT THERE IS HOPE FOR THE FUTURE.

Richard Heinberg Interviewed by Mark Johnson

Gasoline prices are spiraling, nations are fighting over oil, economies are collapsing and protesters are taking to the street in cities around the world. Coincidence? Not on your life.

In his new book The End of Growth: Adapting to Our New Economic Reality, Richard Heinberg connects the dots, revealing what the smart money already knows: You can’t have unlimited growth without cheap energy and easy credit. And both of those are drying up. Prepare to live differently.

Heinberg—an energy expert and educator who has written ten books—leads an ongoing campaign to transition the U.S. economy away from fossil fuels. He is also Senior Fellow-in-Residence at the Post Carbon Institute, a nonprofit organization dedicated to building sustainable communities.

HUSTLER: Is the current economic recovery real?

RICHARD HEINBERG: We have managed to produce a technical recovery over the past couple of years through enormous amounts of government intervention. We’ve bought ourselves some time, but it came with a big price tag—several trillion dollars if you total it all up in stimulus spending and bailouts for the banks.

The problem is it’s all temporary. It wasn’t an ordinary recession, and this isn’t a standard recovery.We’re not shifting back into a normal growth mode where we can expect declining unemployment, increased productivity, higher profits and increased return on investments. We are in the early stages of a much longer-term economic shift that is going to look like the Great Depression, only worse and longer-lasting.

Twenty-twelve could be a key year. In 2008, the mother of all debt bubbles burst. That crisis was papered over with bailouts that enabled the banks to hide trillions in toxic assets. It’s only a matter of time before those toxic assets get to market. When that happens, much of the financial industry will be revealed to be insolvent.

The Europeans are also going to extraordinary lengths to contain their debt crisis, but there’s not much they can do. When the European bubble bursts, it’s going to infect us. U.S. banks own European bonds and have interlocking investments with European banks. There’s no way you can keep that sort of thing contained.

The global economy is imploding, and we’re running out of oil at the same time. What’s the connection?

Cheap energy fed economic growth during the 20th century, and the era of cheap energy is coming to an end. There are all kinds of unconventional fossil fuels out there being touted as the next great energy source, but all of them are very lowgrade substitutes. They have a much lower energy return on the energy we invest getting them out of the ground and processing them.

The entire economy depends on energy. If oil becomes too expensive or the oil flow is shut off, the economy goes into a tailspin. We’ve seen this repeatedly over the past several decades. In 2008, we saw the oil price spike up to almost $150 a barrel, and almost immediately the global economy crashed. The housing bubble burst at the same time. Where did it start? In suburban areas where people were spending a large portion of their paycheck to fill up the tank in their SUV.

By September 2008, we were seeing the collapse of Lehman Bros. and the near-collapse of the entire Wall Street banking industry. As energy gets costlier and more scarce, the entire economy has to contract and adapt in response. Wall Street has its way of making the problem worse by spinning out debt on the basis of expectation of future profits. Even if we didn’t have the problem of peak oil, we would be facing a financial crisis as a result of overreliance on debt and unrealistic growth. But combine those two things—limits to cheap energy and limits to debt—and you have a historic challenge to civilization itself. We’re looking at a whole generation of social, economic and political chaos.

Go ahead and lay the blame. Whose fault is it?

It’s everybody’s fault in that we all got hooked on economic growth and cheap energy. We’ve all participated in the consumer bonanza. But some of us have profited from this situation more than others.

The government commission that was appointed to analyze the financial crash of 2008 came to the conclusion that there was criminal behavior on the part of executives at several institutions, including Goldman Sachs. So far no one has been prosecuted. Clearly that is a political failure. People should be in prison as a result of what was done.

Every politician wants to promise more economic growth. Can you imagine being a politician—either Democrat or Republican— and having to stand up before your constituents and say, “Well, this is it folks. We’re going to have to tighten our belts and do with less because we’ve reached the end of economic growth”? The electorate is going to vote for someone who promises more, cheaper and faster even if it can’t be delivered. All these bailouts are aimed at salvaging economic growth.

Is it a losing game?

It’s inevitable that we will get rid of the growth ideology, not because we suddenly all wise up, but just because it becomes impossible to maintain growth. The growth we’re hooked on is not something that’s been going on for centuries or millennia. It’s only been happening for a few decades. The normal condition is very slow growth, stasis or occasional contraction.

We’ve gotten to a point in history where economic growth as we’ve known it is probably finished. We should have known this point would arrive because you can’t grow anything forever on a finite planet. In fact, we were warned back in the early 1970s by a best-selling report called The Limits to Growth, which told us that growth would come to an end sometime in the early part of the 21st century.

After that report, it ought to have been clear to policymakers that nations should be making plans for an eventual end to economic growth. But as far as I can tell, no such Plan B exists. That is a catastrophic failure on the part of our political system. Since about 1980, most of America’s economic growth has been based on increasing debt. Debt has grown faster than gross domestic product in almost every year. Now we’ve reached the limits to what we can do not only with cheap energy but also with debt. At this point the only thing we can do is hunker down, get back to basics and learn how to live in an economy that’s not growing.

What does that mean on the individual level?

The first thing to do is get out of debt. Debt becomes more and more of a trap in this kind of a situation. If you’re going into debt, you’re assuming your economic circumstances are going to be better a few years down the line. That’s an unrealistic assumption at this point in time for almost anyone to make. This is a good time to be paying off debts, reducing consumption and learning how to be more self-sufficient.

Advertising has deliberately stoked human wants and desires in order to create opportunity for economic growth. We have to find ways of satisfying our innate desire for novelty that don’t express themselves through taking the credit card to the mall and maxing it out. Learning to satisfy those urges by doing things that actually improve our survival prospects. Learning how to grow food and preserve food, getting chickens for the backyard and learning how to take care of them are activities that are actually very pleasurable and can be quite absorbing. But they actually improve our survival prospects rather than diminish them, which is what happens when we go shopping.

The challenge that’s facing us is one that is best faced in a cooperative and collective way. The tendency is to go out and become a survivalist and stockpile ammunition and gold, but I don’t think that’s going to get anyone very far under the conditions that are developing. The best we can do is try to work together within our communities to build trust because trust is going to be our most important currency. That will mean sharing more, volunteering more, figuring out what are the needs within our communities and how we can work together to fill those needs. These are the kinds of things that people do in hard times. If you look back at how people survived the Great Depression, for example, they did exactly these kinds of things. It’s human instinct to pull back and regroup.

What would a post-growth economy look like?

It looks a lot like an ecosystem. In an ecosystem, the total amount of energy and materials flowing through is pretty much the same from year to year, and yet an ecosystem is a dynamic thing. Some species are expanding in numbers, others are declining, and there’s general competition for the available energy and nutrients.

A post-growth economy is going to be dynamic. What makes it different from our current economy is that there will be no realistic expectation of living off of returns on investments. In a growing economy, credit and debt become central features, and a large class of people is able to live off investments and unearned income. In a nongrowing economy, everybody’s going to have to pull his own weight.

Corporations were a signal feature of the growth era of economic history. I’m not sure that they’re very well adapted to the post-growth era. I foresee cooperatives and guilds and individual producers competing and cooperating in various ways to make the economy go. A nongrowing economy looks and feels much healthier because everyone is playing by the same rules.

What are the first things you would do to fix the current economic system?

The first would be to get rid of gross domestic product as a measure and target for economic performance. We have to begin to see quality of life as our main goal. The second would be to provide the basics for everyone. I’m talking about food, shelter, basic medical care, education, family planning. Having access to those basics will give us a platform of social stability to enable us to deal with the whole range of challenges coming at us.

A lot of people will read this and think, This guy is a socialist.

Socialism was a utopian program. I’m talking about the needed immediate response to an almost-wartime situation. In times of war, governments resort to extraordinary economic measures—like rationing fuel and food—to make sure that there’s a platform of social stability to support the extraordinary effort that the entire society is undertaking.

We have to seriously begin to deal with the limits of the natural world: limited oil, topsoil and fresh water. We have to undertake a fundamental reorganization of our economy and patterns of consumption so that we live within those limits. That means reforming our transport system, our food system and just about everything else.

It may be possible to persuade at least local policymakers that these kinds of efforts are in everyone’s best interests, but it is going to be a battle for economic space. I think those of us who understand what’s at stake are going to have to roll up our shirtsleeves and get into that fight. I don’t see any other way around it.

Is the Occupy movement a step in the right direction?

One of my concerns with the Occupy movement has been that it is almost inevitably focused around questions of distribution of wealth. That’s perfectly legitimate, but that’s not the essence of the crisis that we’re facing. We’re facing the end of an entire economic paradigm, and coming to terms with that is really going to require a change—not just in Washington, D.C., but in every household around the country.

I think we’ve only seen the beginning of the Occupy movement. I would call it a global end-ofgrowth uprising because the Occupy movement is just our domestic version of what’s been going on in many countries around the world.

We’ve created a situation of structural corruption. We’ve removed all sorts of financial regulations. We’ve made it easier for corporations to contribute to political campaigns, and the result is now all three branches of government are complicit in this structural corruption, so there’s no way to alter that situation from within the system. You can’t just vote for the other political party because, in fact, both [major] political parties are now owned by Wall Street. The only way out is a general mass protest, such as the Occupy movement.

As long as economies are growing, people are willing to put up with a lot of political corruption and dysfunction. But once the economy stops growing and people are hurting in their daily lives, they’re willing to put up with a lot less. So if our economy is about to go back into crisis mode, we’re likely to see much more in the way of social unrest. More people will be in the streets with stronger demands. Just as the protesters in other countries have overthrown governments, the same thing will happen in this country.

Governments can only maintain power with the consent of the people. Once that consent is withdrawn, all bets are off.

——————————————

For more information, go to PostCarbon.org and EnergyBulletin.net. The End of Growth can be purchased at RichardHeinberg.com.